Microsoft: Undervalued Tech Titan With Upside Potential (NASDAQ:MSFT)

[ad_1]

lcva2

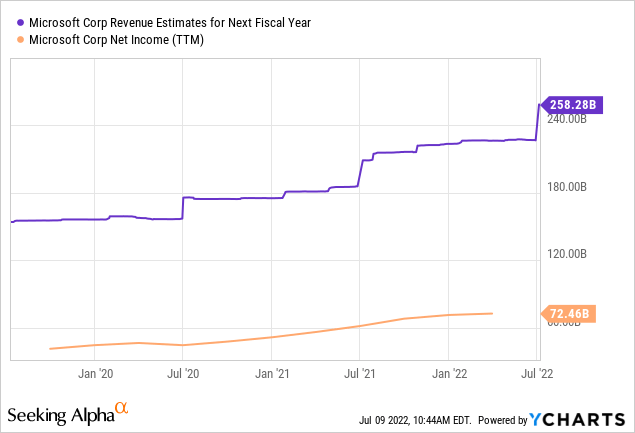

Microsoft (NASDAQ:MSFT) is a $2 trillion mammoth of the technology industry which really needs no introduction… but here is one anyway. Founded in 1975 Microsoft battled, acquired and stormed its way to a monopoly like position in personal computing with its Windows operating system and accompanying software. Although, they weren’t the first in many office applications from Excel, which was predated by Apple’s (AAPL) Visicalc in 1979 to Lotus Software which gained a first mover advantage in office applications, Microsoft still managed to come out on top. When Bill Gates handed over the reins to Satya Nadella in 2014, he had big shoes to fill. Nadella has rose to the challenge and delivered to shareholders over a 500% return since 2014. Despite having such a large revenue base ($168 billion in revenue in FY21) the company has consistently delivered a 15% average revenue growth rate over the past 5 years.

The stock price has pulled back by ~20% since the highs in December 2021. This was mainly driven by the high inflation, rising interest rate environment in addition to forex headwinds and regulatory scrutiny. But for a mammoth like Microsoft these are like flies on a freight train. The stock is now undervalued intrinsically and guidance is still strong. Thus, let’s dive into the solid Business Model, Financials and Valuation for this Tech Titan.

Solid Business Model

Microsoft’s mission to “empower every person and organization” on the planet to achieve more. It accomplishes this through its robust business model, which can be divided into three main segments.

- Productivity and Business Processes

- Intelligent Cloud

- More Personal Computing

i. Productivity and Business

The Productivity suite includes Microsoft Office 365 which had approximately 345 million paid seats as of the first quarter of 2022. This was up a blistering 72% since the 200 million paid seats in early 2020. This growth was driven by the need for enterprises to offer secure and fast remote working to employees. Microsoft Teams had 270 million monthly active users (as of Q421) which makes it one of the most popular Video conferencing platform in the world. Zoom (ZM) reportedly has 300 million daily active users and thus may be slightly ahead, although the data on exact users is scarce. The world’s number one professional social network LinkedIn is also part of Microsoft and saw revenue growth of 34% YoY, driven by a strong job market.

ii. Intelligent Cloud

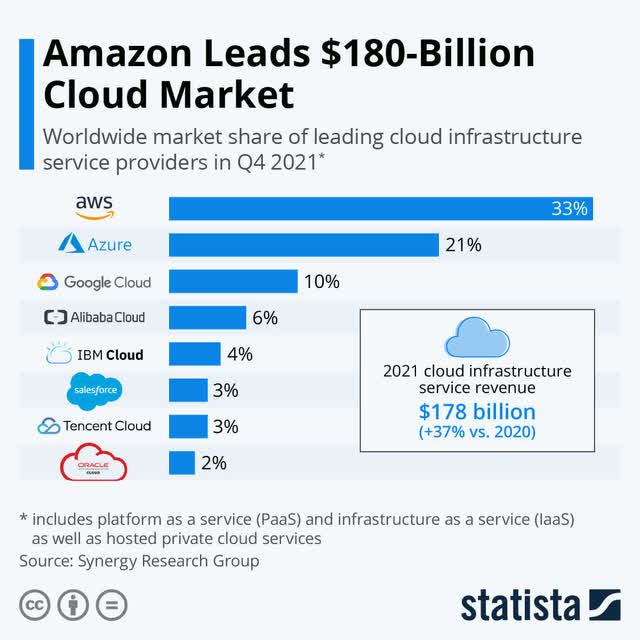

Microsoft Azure is the 2nd largest cloud provider globally with a 21% market share as of Q421. Amazon Web Services (AMZN) is the largest with 33% and Google Cloud trails the “Big two” with a 10% market share.

Cloud Market share (Statista)

Cloud is the fastest growing part of Microsoft’s business and saw a major boost during the pandemic as more enterprises went through a “Digital Transformation”. The global cloud computing market was worth $445 billion in 2021 and is forecasted to grow at 16.3% CAGR to nearly $1 trillion by 2026. Microsoft’s Cloud segment has historically grown faster than the industry with a 29% growth rate achieved for the quarter ending in March 2022. Azure benefits from economies of scale as a big three cloud provider. They can deploy computational resources at a lower cost per unity and thus have a strong moat despite offering what seemingly is a commodity (computing resources).

The “Intelligent Edge” is also another growth driver which aims to bring the power of the data centre locally to IoT (Internet of Things) devices. This is set to enable a host of new applications where live data transfer is a necessity to the experience. For example, with regards to 3D video live streaming, AI, Augmented Reality and the Metaverse.

iii. More Personal Computing

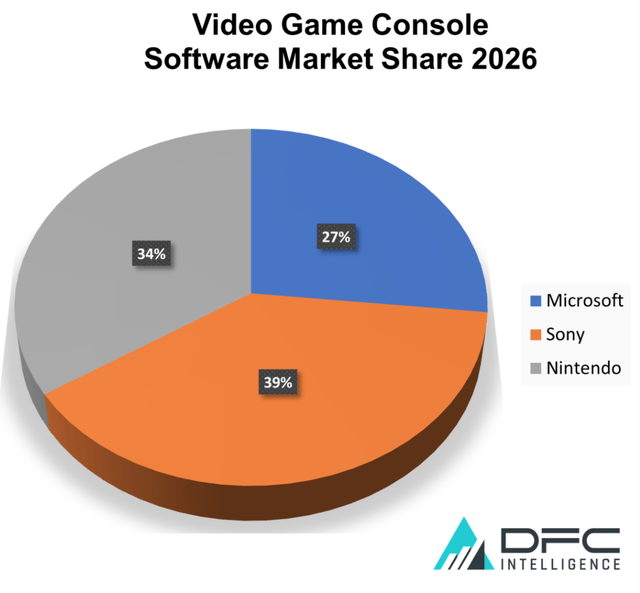

The More Personal Computing offers a mix of hardware, software, and gaming systems. These include the Microsoft Xbox, which competes with the Sony PlayStation (SNE) and Nintendo (OTCPK:NTDOY). PlayStation is currently leading the pack with a 43% share of the console market, followed by Nintendo at 37% and Xbox with 20%. However, Gaming market analysts predict Xbox to a 7% market share by 2026, while PlayStation would lose a 4% share and Nintendo 3%. Part of this growth is forecasted to be driven by the Latin American market, where online distribution and cloud gaming is expected to equal increased growth for the Xbox.

Gaming Console Market share forecast (DFC intelligence)

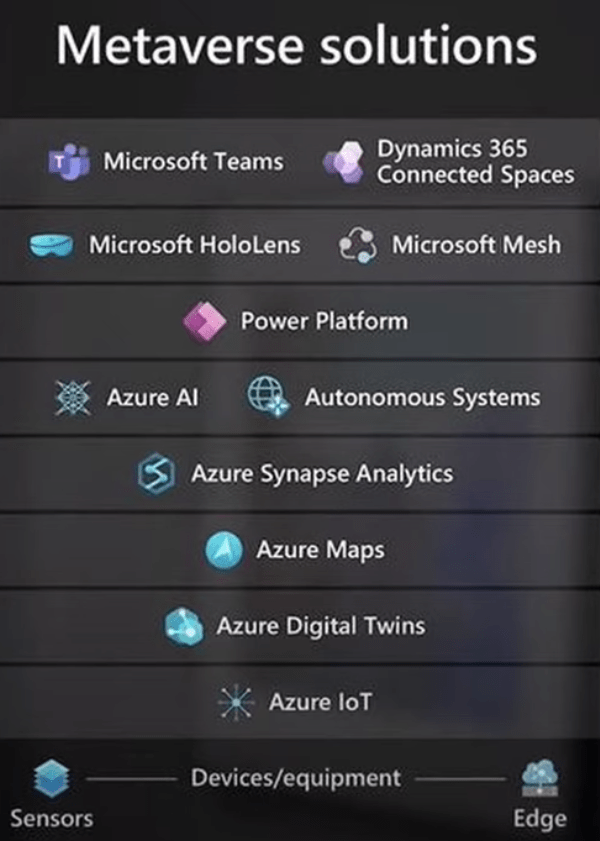

Metaverse

Microsoft has all the ingredients to make the Metaverse a reality and easily scale mass adoption. The Azure Cloud service would act as a cost efficient backbone for the technology. While the VR headset (Microsoft HoloLens) combined with Teams’ 370 monthly active users, enables easy connection into the space. Microsoft’s Gaming roots from the Xbox, its array of gaming studios and even the recently announced acquisition of Gaming giant Activision Blizzard will all give Microsoft an edge over competitors such as Meta Platforms (META), formerly Facebook. Meta has the vast social network, but I believe they may be lacking on the gaming software side.

Metaverse (Microsoft Metaverse Presentation)

Microsoft’s Mesh platform is set to enable the connection with a “holographic presence” and enable mixed reality experiences for organisations, to build that sense of “presence”. The Virtual reality industry is forecasted to grow from $16.7 billion in 2022 to over $227 billion by 2029, expanding by a blistering CAGR of 45%.

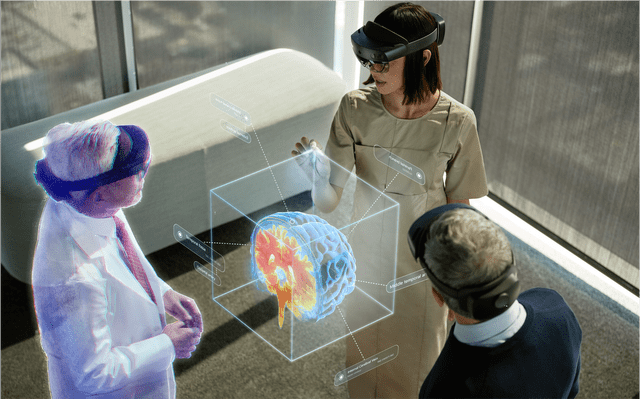

Microsoft Mesh Hologram preview (Microsoft)

With regards to Headsets, Meta’s Oculus is leading the pack in VR headsets with an 80% market share as of Q421. However, I believe Microsoft HoloLens can carve out a substantial gap in the Enterprise and Manufacturing industry. According to a recent review of the latest HoloLens vs Oculus, they state:

“With the Microsoft HoloLens 2, engineers can overlay information about a machine onto the device itself and see instructions in front of them, without having to search through a manual.

If you’re hoping to empower professionals in the field, support specialists in challenging environments, and enable more immersive creative experiences, the HoloLens 2 is the right pick”.

Back in college I designed an early prototype of a similar augmented reality solution which was used by the manufacturing industry thus you could say I have roots in the market. Today, HoloLens is used by the world’s largest automotive company (by volume) Toyota (TM) for vehicle repairs, training of employees and maintenance. Although the whole idea of the “Metaverse” is still yet to materialise into real revenues it offers low risk optionality in Microsoft’s stock. Whereas, with a company like Meta Platforms, they are literally betting the future of “Facebook” on the idea, which is more risky for investors.

Roaring Financials

Microsoft announced strong earnings for the quarter ending March 31st 2022. It generated revenue of $49.4 billion, up a blistering 18% year over year. This revenue growth was driven by the rapidly growing cloud segment which increased by 26% to $19.1 billion or 40% of revenues. Productivity and Business Process revenue popped by 17% to $15.8 billion. This was driven by strong growth (17%) in Office 365 commercial revenue and Dynamics 365 which increased by 35%. LinkedIn also showed strong growth with revenue for this segment increasing by 34%.

The “More Personal Computing” segment popped by 11% to $14.5 billion, driven by Windows Commercial Products revenue (up 14%) and Advertising revenue (up 23%).

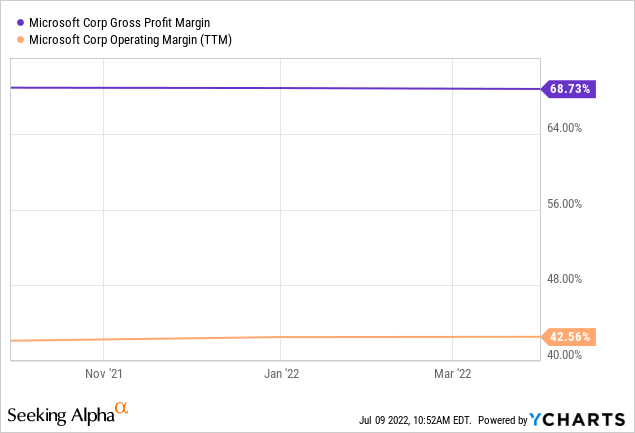

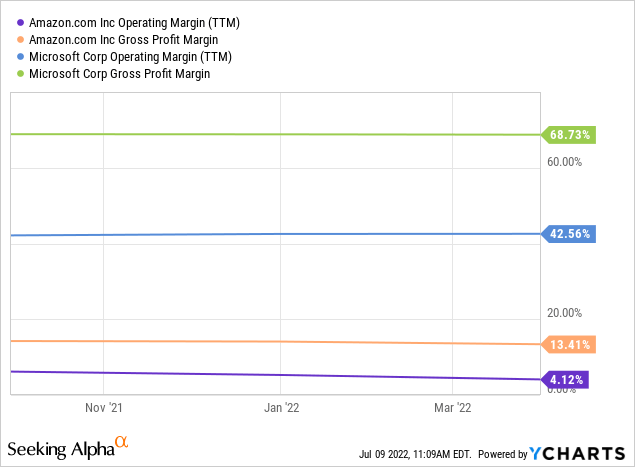

Operating income increased by a rapid 19% YoY and net income jumped by 8% to $16.7 billion for the quarter ending March 31st 2022. Diluted earnings per share were $2.22, which beat analyst expectations by $0.02 and increased by 9% GAAP year over year. Microsoft has an extremely high gross margin of 69% and operating margin of 43%, which is substantially higher than the 25% average for the software industry. In short, Microsoft is a cash generating machine with high margins and growth.

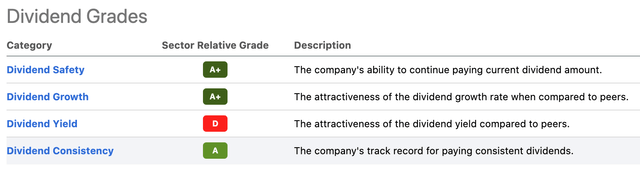

Microsoft has a fortress balance sheet with $105 billion in cash and short term investments. They have a substantial $48 billion in long term debt but just $1.7 billion is in short term debt and thus manageable. In the latest quarter Microsoft returned $12.4 billion to shareholders through buybacks and dividends, up 25% compared to the same period last year. At the time of writing Microsoft pays a 0.93% dividend, this isn’t very high but is better than most technology companies which don’t usually pay any dividend at all. As an investor I would actually be worried if they started to increase the dividend as it would likely mean they didn’t have sufficient investment opportunities for growth. The Seeking Alpha Dividend Grades below show an A+ for Dividend Safety and A for Consistency. As mentioned prior the “D” rating for Yield makes sense and is not a negative as far as I’m concerned.

Dividend Microsoft (Seeking Alpha)

Valuation

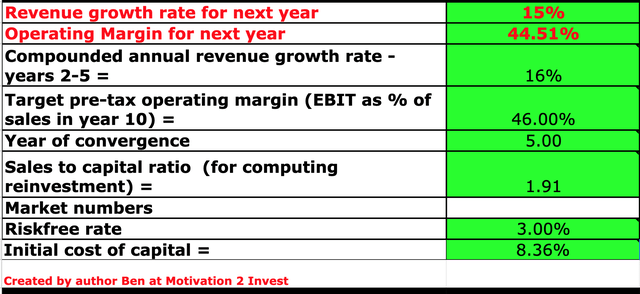

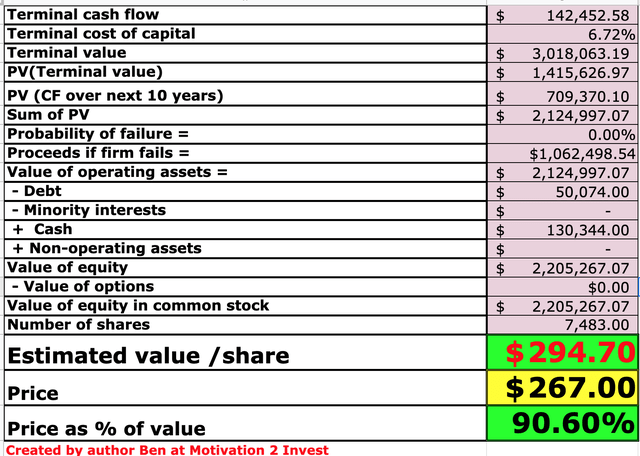

In order to value Microsoft I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted 15% revenue growth for next year and 16% for the next 2 to 5 years in line with analyst estimates.

Microsoft Valuation Model (created by author Ben at Motivation 2 invest)

I have forecasted the operating margin to increase slightly to 46% over the next 5 years, as Cloud becomes a great portion of revenue and the company reaches even greater scale.

Microsoft Stock Valuation (created by author Ben at Motivation 2 invest)

Given these factors I get a fair value of $294/share, the stock is currently trading at ~$267/share and thus is ~10% undervalued.

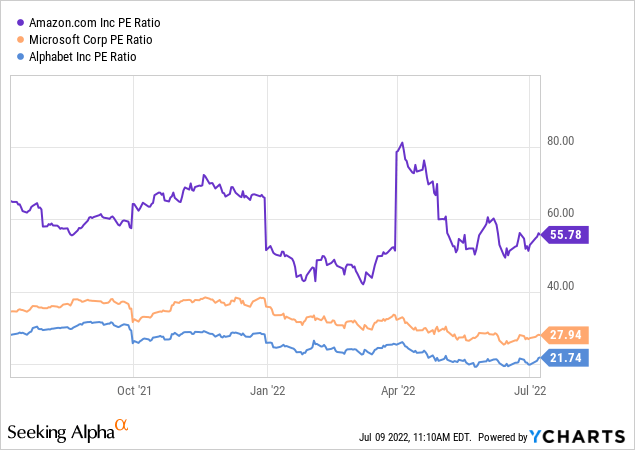

Microsoft also trades at a forward Price to Earnings ratio = 25, which is lower than historic levels seen in 2020. The company also has immensely better margins than Amazon which in my eyes is a testament to the quality of the business model.

Amazon’s low operating margin gives them a sky high PE ratio = 56, which is more expensive than Microsoft which trades at a PE Ratio = 28. However, Alphabet trades cheaper with a PE = 22, but that company’s revenues are notoriously more volatile due to advertisers pulling ad spend at the first sign of any “recession” or “headwind”. As Alphabet makes ~90% of its revenue from advertising, they are less diversified than Microsoft.

Risks

Activision Merger Under Scrutiny

The proposed $69 billion acquisition of Activision Blizzard has recently come under scrutiny from UK regulators. They announced an investigation to see if the merger will impact competitive dynamics. If the deal doesn’t go through Microsoft will have to pay between $2 billion and $3 billion. Although, this is not a gamechanger for Microsoft as they have over $100 billion in cash and short term investments of its balance sheet, it is still not “change” by any means.

Antitrust Concerns

The prior point highlights the risk of further scrutiny, lawsuits and even fines by regulators. With a $2 trillion market cap, Microsoft can’t really hide and is a prime target for attacks. As far as I’m concerned this is just part of the cost of being successful and will not be a major issue, but it is still a risk which can impact stock prices in the short term.

Final Thoughts

Microsoft is a mammoth of the technology industry and have some of the highest margins in the industry. The have multiple engines of growth which include its rapidly growing Cloud business to Microsoft 365. The Dominant professional social network (LinkedIn) and one of the “big two” gaming consoles (Xbox) also helps to further diversify the revenue of this giant. Microsoft has the potential to become a leader in the “Metaverse” which adds optionality to the stock, while the stock is currently undervalued at the time of writing. Overall, Microsoft has all the ingredients to continue its dominance for the decades ahead.

[ad_2]

Source link